Strategic Financial Planning for Growth and Innovation

The rapidly evolving nature of the cybersecurity industry demands continuous innovation and scalability. We work with you to develop strategic financial plans that support sustainable growth, including budgeting for R&D, managing cash flow, and planning for significant capital investments. Our services also include evaluating potential mergers and acquisitions, conducting valuations of your technology assets, and advising on the financial implications of expanding into new markets. By aligning your financial strategy with your business objectives, we help ensure that your company remains competitive and prepared for future challenges.

Cybersecurity companies operate in a heavily regulated environment, particularly when handling sensitive data or providing services to clients in regulated industries. We assist in navigating compliance with data protection regulations such as GDPR in Europe and CCPA in California, ensuring that your financial practices support full compliance. This includes implementing proper accounting for costs associated with compliance and reporting requirements, as well as understanding the tax implications of fines or penalties for non-compliance.

Compliance with Data Protection and Privacy Regulations

Revenue Recognition and Compliance for Cybersecurity Companies

For cybersecurity firms, particularly those involved in network security, endpoint security, and IAM, accurately recognizing revenue is crucial due to the complex nature of service contracts and software licensing agreements. ASC 606 provides guidelines on how to recognize revenue from contracts with customers, which can be particularly challenging when dealing with multi-year contracts or subscription models. We help ensure that your revenue recognition practices are aligned with GAAP standards, providing transparency and compliance. This is essential for presenting a clear financial picture to investors and regulatory bodies.

Tax Strategies for Research and Development

Cybersecurity companies invest heavily in research and development to stay ahead of evolving threats. We help you leverage R&D tax credits under IRC Section 41 to reduce your tax liability by identifying and documenting qualifying R&D activities, such as the development of new encryption technologies or advanced intrusion detection systems. Additionally, we provide guidance on the tax treatment of capital expenditures related to R&D, ensuring you maximize deductions and credits, thereby freeing up capital for further innovation.

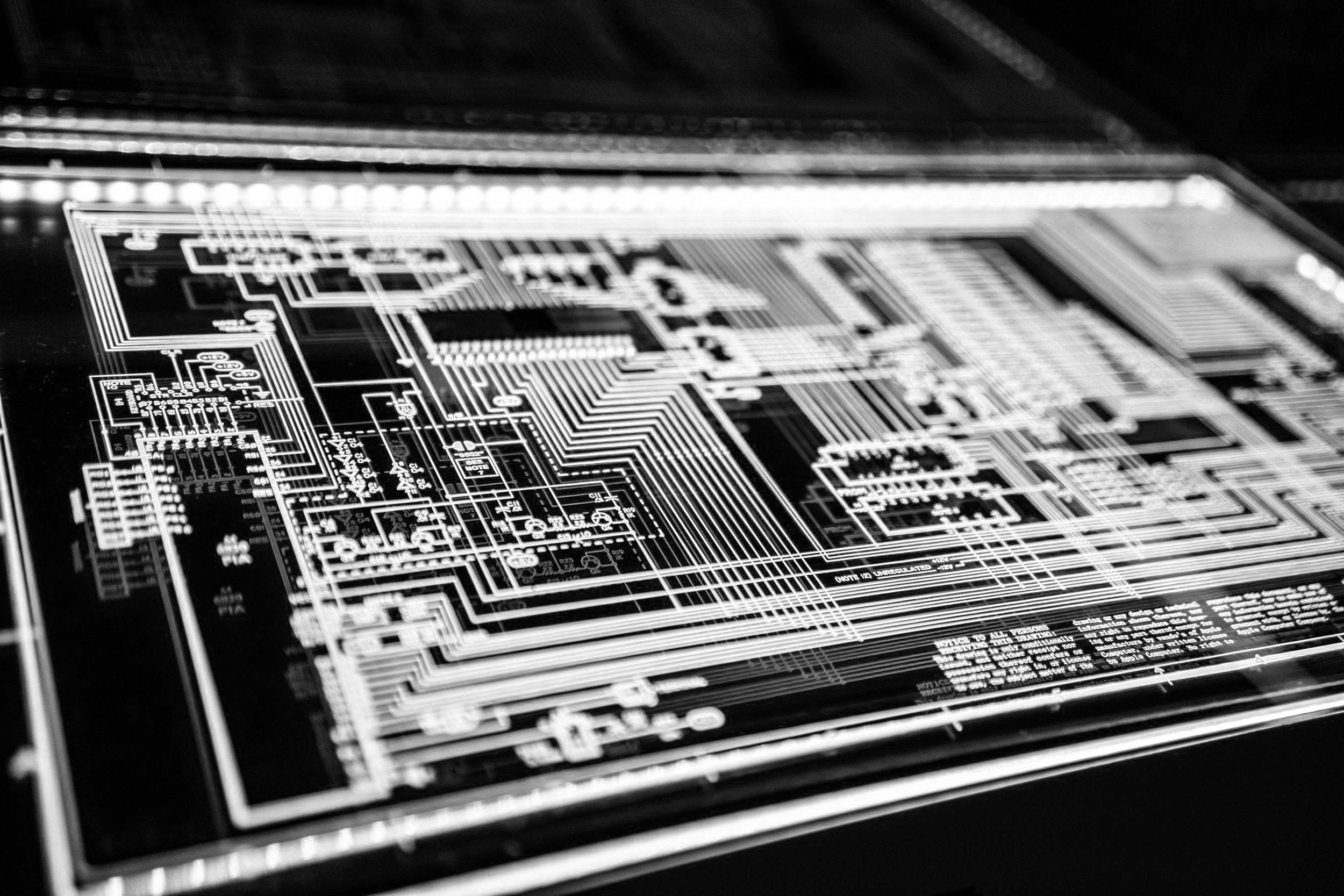

Managing Capitalization and Depreciation of Technology Assets

The cybersecurity industry requires significant investment in technology infrastructure, from servers to advanced encryption hardware. Understanding when to capitalize versus expense these costs is critical for tax planning and financial reporting. We assist in applying IRC Section 179 for immediate expensing of certain equipment and using MACRS (Modified Accelerated Cost Recovery System) for depreciation. This approach helps optimize your tax position and ensures that your financial statements accurately reflect the value of your technology investments.